Winter 2002, Volume 19.2

READING THE WEST

read-ing [from ME reden, to explain, hence to read] _ vt. 1 to get the meaning of; 2 to understand the nature, significance, or thinking of; 3 to interpret or understand; 4 to apply oneself to; study.

The Federal West

The New Western Historians (See The Oxford History of the American West, edited by Clyde A. Milner II, Carol A. O'Connor, and Martha A. Sandweiss, 1994) argue that the significance of the West as a region is not Frederick Jackson Turner's grand thesis that the existence of free land and the advance of Anglo American settlement westward explain American development, American democracy, and even American character. Rather, they argue the significance of the West is in other realities, two of which are (1) the impact of the federal government and (2) the exploitation of resources.

The New Western Historians argue that the federal government has played a huge role in a region supposedly characterized by personal freedom and rugged individualism—a role characterized by the federal government taking the land in the first place, retaining that land, providing a great deal of the economic investment in that land, and, consequently, developing land-management programs which continue to shape the region.

The West has seemed a cornucopia of resources; yet the "myth of super-abundance," as Arizona's Stewart Udall termed it in the 1960s, has obscured a fragile natural environment. Economic development in the West has resulted in large-scale environmental costs—for the land and its inhabitants, human and non-human.

One way of looking at the involvement of the federal government in the West is to consider how much of the federal tax dollar is returned to the region. The Northeast-Midwest Institute is a Washington-based, private, non-profit, and non-partisan research organization dedicated to economic vitality, environmental quality, and regional equity for Northeast and Midwest states. The Institute recently, 5 September 2001, issued the following statistics:

SOURCE: The Northeast-Midwest Institute, Economic Data, https://www.nemw.org/taxburd.htm.

Changes in Federal Benefits

The Tax Foundation has monitored fiscal policies since 1937. They publish a special report series "Federal Tax Burdens and Expenditures by State." In their most recent report, Scott Moody points out:

…During fiscal 2000, taxpayers in New Mexico benefited the most from the give-and-take with Uncle Sam. Residents of New Mexico received $2.03 in federal outlays for every $1.00 they paid in federal taxes. No other state got a 2-1 ratio, but Uncle Sam spent $1.86 in North Dakota for each tax dollar, $1.78 in Mississippi, and $1.75 in West Virginia. (Though not comparable as a state, the District of Columbia is by far the biggest beneficiary of federal spending: In 2000 it received $6.49 in federal outlays for every dollar its taxpayers sent to the U.S. Treasury.)

Factors influencing the shifting of federal dollars include the location of people who receive Social Security, Medicare and other substantial federal entitlements, the location of federal employees, federal procurement decisions, and grants to state and local governments.

The state that raised its ratio the most is Alaska where federal spending rose from $1.20 to $1.68 for each dollar in taxes. This 48¢ increase over the decade of the 1990s beat out Hawaii where federal spending increased 43¢ per dollar of tax, West Virginia (36¢ more spending per dollar), North Dakota (34¢ more spending per dollar), Oklahoma (22¢ more spending per dollar), and Vermont (21¢ more spending per dollar).

States that have not fared so well include Colorado, Utah, Massachusetts, and Connecticut. Of these, Colorado saw the largest decline, with its federal spending-to-tax ratio falling from $1.16 in FY 1990 to 85¢ in FY 2000. Utah's has dropped 28¢, Massachusetts's has dropped 22¢, and Connecticut's has dropped 16¢.

SOURCE: Tax Foundation, "Tax and Spending Policies Benefit Some States, Leave Others Footing the Bill," 29 June 2001. https://www.taxfoundation.org/pr-fedtaxspendingratio.html

Federal Funding for Winter Olympics

Utah may regain its ranking in the federal spending comparisons this year if the Winter Olympics funding is counted. A recent General Accounting Office report estimated the federal government will spend $342 million on the Games, or 18 percent of the nearly $1.9 billion total needed to stage them. CNN/Sports Illustrated described the largess:

Spectators won't have to worry about how to get to most events when the Winter Olympics begin. Shuttle buses will take them across town, up mountains and to the doorstep of every venue. It won't cost them a dime. Taxpayers are picking up the tab.

The most expensive Winter Olympics ever will make ends meet largely because the federal government is picking up the tab for 18 cents on every dollar.

Making sure terrorists don't strike the Feb. 8-24 Games is costly enough. But taxpayers will be paying for a lot more than keeping everyone safe for 17 days.

Federal funds will be used for everything from forecasting weather to promoting a special wild horse adoption program. At least 44 different federal agencies are providing support, including $55,000 by the Department of Justice to assess the amount of racial tension in Salt Lake City during the Games.

A new road into the Snowbasin ski resort, site of the downhill, was funded by $15 million from the federal government, while taxpayers also paid for upgrades to the Salt Lake International Airport, including $2.8 million for new approach lighting.

In all, American taxpayers will spend some $380 million on the Olympics, or more than a dollar for every man, woman and child in the country.

…taxpayers … will pay more for Salt Lake City than the much bigger Los Angeles and Atlanta Summer Olympics combined.

More than half of that money—some $225 million—will go to keep athletes and visitors safe during the Games. But millions will also go to build parking lots, pay for bus drivers and help fund doping control.

…That doesn't include another $35 million to $40 million that is being added to the security budget after the Sept. 11 terrorist attacks. Nor does it include more than $1 billion spent to overhaul the main freeway running through Salt Lake City and put in a light rail line from the suburbs to downtown.

The freeway and light rail costs were included in an earlier GAO report, which said the improvements were expedited so they could be done before the Olympics begin. But a second report last month requested by Utah Sen. Bob Bennett looked at only the direct costs.

Bennett, whose influential seat on the Senate Appropriations Committee helped Utah secure much of its funding, said at the time that the costs were not only reasonable but important for the federal government to fund.

"As I've continually said, the 2002 Games are America's games, not just Salt Lake City's, and the participation of the U.S. government is not only an appropriate responsibility, but a privilege," Bennett said.

SOURCE: "Taxpayers Footing More than Security ," CNNSI, 11 December 2001. http://sportsillustrated.cnn.com/olympics/2002/news/2001/12/11 /federal_money_ap/

Olympic Games Cost U.S. Taxpayers More Than Ever

Julia Campbell reports the Olympics 2002 federal funding controversy beginning in 1984 with the Los Angeles Games:

In 1984, Peter V. Ueberroth made it seem possible that the Olympic dream of hosting the perfect Olympic Games—and one that didn't bankrupt a city—could come true.

The California investor found a way to meld public money with corporate sponsors to put on the Games in a way that actually made money—more than $100 million—for Los Angeles, the host city.

The success of the L.A. Games, some say, kicked off an enthusiasm in this country for hosting the games and spending big money to do it, a trend that has increased federal government spending on the Olympics more than tenfold.

Since 1904, the United States has hosted the Olympic Games eight times, more than any other country. Unlike in other countries, the host cities, not the federal government, are generally responsible for hosting the Games. But, according to a report released by the General Accounting Office, the federal government has played an increasingly expensive role.

…Since the 1984 Olympics, only a quarter of the federal money used to fund the Olympics has gone to projects relating to planning and staging the Olympics, according to the report. The remaining funds have been spent on infrastructure projects such as highway improvements, mass transit and capital improvements.

"I think it is a disgrace," said Sen. John McCain, R-Ariz., who, along with U.S. Rep. John Dingell, D-Mich., asked the government agency to investigate the escalating expenditures for hosting the Olympic Games in American cities. "But this is a logical extension of what you get when you start pork-barrel spending."

But others say that federal spending on the Olympics is justified because the Games help bring together people from many nations.

"Recognizing that our government spends billions of dollars to maintain wartime capability, it is entirely appropriate to invest several hundred millions to promote peace," Mitt Romney, the president of the Salt Lake City Organizing Committee, wrote in a letter in August to the GAO….

While the government report acknowledges that certain infrastructure projects funded in preparation for the Olympics did or will benefit the host cities, the report says that it was difficult to determine which of the projects would or would not have been funded if the cities did not host the Games.

The report mentions a federally-funded sewer construction project in Salt Lake City which the Environmental Protection Agency has said would not be necessary without the Games….

SOURCE: "Olympic Games Cost U.S. Taxpayers More Than Ever," ABCNEWS.com, https://abcnews.go.com/sections/us/DailyNews/olympicspending000922.html.

Holding's Olympic Windfall

One of the most controversial "Olympic Windfalls" is a federal land exchange which benefits Earl Holding, the owner of Snowbasin Ski Resort near Ogden, Utah. Several news media have covered the story, including Sports Illustrated and National Public Radio. Dan Oko reports the story for Mother Jones magazine:

World-class athletes will not be the only ones going for gold at the 2002 Winter Olympics in Salt Lake City this February. All along the scenic Wasatch Mountain front near this booming Western city, business owners expect to profit from the Games' lucrative contracts and worldwide media exposure. Few stand to benefit more than Earl Holding, owner of Sinclair Oil, and one of the richest men in Utah. Holding's Snowbasin ski resort will be the site of several high-profile events, including the men's and women's downhill, super-G, and alpine combined competitions.

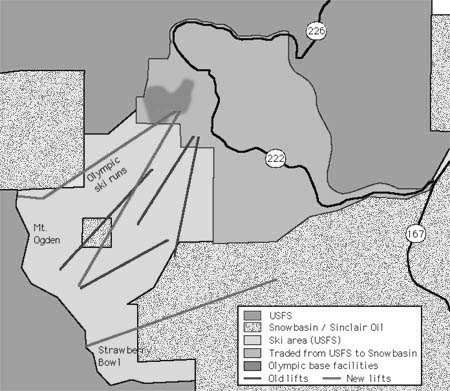

The $14-million contract for hosting the races—along with a new federally financed road connecting Snowbasin to the Salt Lake City airport—is only part of the Olympic windfall for the reclusive 74-year-old businessman. The true prize is a congressionally sanctioned land swap that has added more than 1,300 acres of prime national forest land to the resort.

Ever since its passage in 1996, the swap has been characterized as a necessary element of Salt Lake's Olympic preparations. But Holding's long-term plan for the property has little to do with the Games: Over the next few years, he aims to build luxury homes and condos, hotels, and golf courses, turning Snowbasin into a year-round destination on a par with his celebrated resort at Sun Valley, Idaho.

"You might oppose the swap because it means development is going to take place on this pristine land," says Stephen Pace, chairman of the local public-interest group Utahns for Responsible Public Spending. "But for us there is also the whole way that the land trade took place."

Holding first declared his intention to lobby for a land swap after purchasing Snowbasin in 1984. But Forest Service officials were not impressed with his offer to trade 10,000 acres of undeveloped property in northern Utah for 2,500 acres near the resort. "I sat down with Mr. Holding and told him he had to be more realistic," recalls Stan Tixier, then the regional forester for the area.

In 1990, following the selection of Salt Lake as an Olympic host, Tixier says Holding agreed to a trade involving no more than 700 acres. But by the time the deal came to a vote in Congress as part of the 1996 Omnibus Public Lands Bill, that number had nearly doubled. The bill's sponsors, Utah Republicans Rep. James V. Hansen and Senator Orrin Hatch, argued that the increase was needed to help Snowbasin get ready for the Olympics. To speed development, their measure exempted much of the land from reviews ordinarily required under the National Environmental Policy Act.

Former Forest Service Deputy Chief Gray Reynolds says the deal was always intended, in part, as a financial boost for the resort. "It's part of the job of the Forest Service to provide support and development opportunities for local economies," he explains. Without the prospect of future revenues, he adds, Holding couldn't have afforded to invest in getting the mountain ready for the Olympics.

Reynolds brings a unique perspective to the issue: In 1996, he testified in support of the land swap before Congress. In 1997, he retired from the Forest Service and went to work for Holding as general manager of Snowbasin.

Reynolds wasn't the only key government official to benefit from Holding's generosity. Both Rep. Hansen and Senator Hatch have received significant campaign contributions from Holding, his family members, and his employees, totaling at least $24,000 over the past decade. And in 1993, Holding and his family gave $30,000 to a legal defense fund set up by Hatch in connection with the Bank of Credit and Commerce International scandal.

In Salt Lake, Holding has donated money to a group of business and political leaders that led Salt Lake's efforts to host the Games. And he served on the city's Olympic organizing committee until 1999, when Governor Mike Leavitt requested that members with apparent conflicts of interest resign. Holding's former colleagues on the committee have since designated his Little America hotel as the official International Olympic Committee headquarters during the Games….

Tixier, the former regional forester, says he understands Holding's desire to turn the picturesque, but money-losing, resort into a profitable business. What leaves him bewildered, he says, is why so many public resources were used to support the venture. "It was subterfuge to say that the amount of acreage was necessary for the Olympics," he concludes. "I think it has a bad odor about it."

SOURCE: "Olympic Windfall, with help from his allies in Congress, a Utah businessman cashes in on the Winter Games," Mother Jones. com, November/December 2001, https://www.motherjones.com/magazine/ND01/saltlake.html

Proposal to Reform Western Land Exchanges

Since 1994, the Green Scissors Campaign, led by Friends of the Earth, Taxpayers for Common Sense, and U.S. Public Interest Research Group, has been working with Congress and the Administration to end environmentally harmful and wasteful spending. They have been particularly critical of western Land Exchanges:

Public lands constitute a large percentage of the western United States and often surround or are interspersed with private land. In order to consolidate public and private ownership over larger contiguous areas, the U.S. Forest Service (USFS) and Bureau of Land Management (BLM) frequently swap holdings with private parties, simplifying land ownership patterns and often acquiring important natural resource lands in the process.

Unfortunately, the review process agencies use to conduct the swaps is often misguided and inadequate.

Green Scissors Proposal: Prohibit land exchanges between the federal government and private landowners (including those that are legislated through Congress) until the land swaps have been thoroughly reviewed and their weaknesses remedied. Before moving forward with more land exchanges, targeted audits by federal agencies should investigate the appraisal and environmental/public interest review processes to identify and find remedies for the weaknesses in these areas….

A GAO report released in June 2000 concluded that the BLM and USFS's land exchange programs have shortchanged American taxpayers by millions of dollars through faulty land appraisals that often undervalue public land and overvalue private land.

The GAO also found that the BLM misused its land exchange authority on a number of occasions by selling land and keeping the money for its own purposes rather than returning it to the federal treasury as required.

According to audits conducted by the Department of the Interior's Office of the Inspector General (OIG), three land exchanges conducted in Nevada between 1992 and 1995 lost taxpayers $4.5 million because BLM appraisers undervalued public land and overvalued private land.

Land swaps often subsidize industry and facilitate development. Resource extractors may trade lands they have stripped of resources for public lands from which they can reap further profits. Recent beneficiaries have included Weyerhaeuser, Big Sky Lumber, and Crown Pacific timber companies, Phelps Dodge and other mining companies, and land developers such as Del Webb.

When companies exchange their exploited lands back to the federal government, they avoid cleanup obligations, thus sticking taxpayers with the cost of decommissioning logging roads and implementing restoration on damaged lands

SOURCE: "Western Land Grab Revisited" Green Scissors 2001, http://www.greenscissors.org/publiclands/landexchanges.htm.

Federal Subsidies/Environmental Issues

The United Nations Environment Programme, in their Global Environmental Outlook 2000, explains the relationship between federal subsidies and environmental problems:

…Subsidies for natural resource extraction are one widely-used though difficult-to-measure fiscal incentive. The United States, for example, indirectly subsidizes logging in national forests by providing logging roads built with public funds, and grazing of livestock on federal lands, by charging less than market rates for grazing permits. Similar subsidies support use of water for irrigation in the arid, western portions of the country, and mineral extraction from and recreational use of public lands. These subsidized activities have placed heavy burdens on the country's natural resources. According to the OECD, the United States provided about US$46,960 million in agricultural producer support in 1998; the corresponding figure for Canada was US$3,184 million. Farmers using irrigation water from federally-supported projects pay on average only about 17 per cent of the actual cost, and the total water subsidy in the western United States is estimated at about US$4,400 million….

…US policy could eliminate subsidies for grazing livestock on public lands. The US Forest Service and the Bureau of Land Management administer the country's livestock grazing programme. The two agencies charge ranchers a fee based on an `animal unit month,' which is the amount of forage that one adult cow with calf or five adult sheep require for one month.

Studies show that the fees do not cover the costs for administering the programme, and that they are below the market rate for grazing on private lands. Such subsidies are opposed by those who argue that low grazing fees and lax supervision have encouraged overgrazing and have led to soil erosion, watershed destruction, loss of native grasses and other vegetation needed as food for wildlife and livestock, and elimination of forage reserves needed to withstand periodic drought. The most direct reform policy would be to raise grazing fees to cover the administrative costs, or to match estimates of market value, thus eliminating subsidies.

In short, the North American region constitutes a good example of the potential to reduce environmental pressures by reform of various forms of subsidies…. In relation to the Western States, for example, the maturation of economies with reduced reliance on resource extraction, the increased value placed on the environment by the public, and a desire to reduce the federal deficit are motivating new objectives for federal natural resource policy which will place more emphasis on market mechanisms while reducing subsidies. Ironically, this form of alternative policy ultimately results in the reduction of government involvement—contrary to the widely-held belief that environmental policy always requires more government involvement….

SOURCE: "Future Perspectives…North America," GEO-2000, https://www.unep.org/geo2000/english/0231.htm

Welfare Ranching

Forest Guardians is a New Mexico based conservation organization which lobbies to preserve and restore native wildlands and wildlife in the American Southwest through reform of public policies and practices. They are particularly concerned about grazing fees. They and others are using the term "welfare ranching" to describe federal subsidies:

Despite projecting an image of rugged independence, western public land ranchers are propped up by cheap grazing fees and a host of federal handouts which collectively amount to $500 million per year. Arid land ranching only appears to be economically viable because taxpayers pick up most of the operating costs.

Public Land fees are one-fifth the going lease rates on private lands. The 1996 fee is $1 less than it was in 1980, a decline of 350 percent in real dollars. Grazing fees are so pitifully low that taxpayers annually contribute over $70 million to cover the shortfall between fee revenues and range program operating costs….

In the arid Southwest, drought is common, yet the Department of Agriculture doles out $150 million annually through its emergency feed program to keep ranchers afloat. As a result, ranchers graze cattle on cow-blasted land that never should be grazed. In New Mexico, the average payment to individuals is more than $3,000 per year. Other USDA assistance programs, such as brush control, grasshopper control, and flood relief add to the taxpayer burden….

Free roaming cattle are a common sight in the West, courtesy of 19th century open range laws. Today, taxpayers, not ranchers, are being forced to fence ranchers' land to prevent car accidents with cattle on county roads. At $1,000 per mile, fencing roads in Santa Fe County alone would cost nearly $2 million.

SOURCE: "The High Cost of an American Myth," https://www.fguardians.org/highcost.htm